The increase in corn supply in 2024 may overlap again with weak consumption

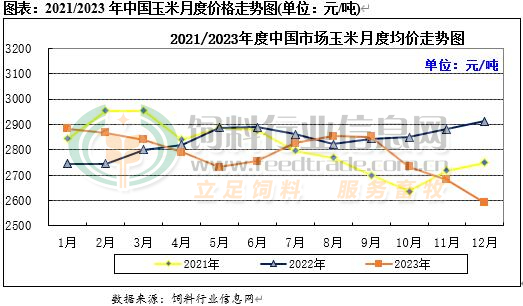

In 2023, domestic corn will experience a high yield. Under the pressure of factors such as increased wheat substitution and low import grain prices, downstream consumer demand is relatively weak, and the pattern of oversupply is more obvious, resulting in an overall downward trend of corn prices. According to the tracking survey results of China Feed Industry Information Network, the average price of corn in the main producing areas this year was 2784 yuan/ton, a year-on-year decrease of about 53 yuan/ton, a decrease of 1.87%.

From the supply side, the overall water and heat conditions in the main production areas of China are good, and the expected high yields in most areas are relatively obvious. The overall corn production in China has increased this year. At the same time, in 2023, China will continue to accelerate the further construction of a diversified pattern of corn imports. The corn production and import volume in 2023 present a trend; Double Increase” Trend, with a production of 288.84 million tons, a year-on-year increase of 4.2%; The import volume was 27.13 million tons, a year-on-year increase of 31.6%.

From the demand side, downstream breeding profits continue to weaken and turn into losses, while processing profits have not shown significant improvement. The situation of sluggish consumption during peak seasons is quite common, which is transmitted to the feed and deep processing markets. The total consumption of corn in 2023 is about 278 million tons, including 188 million tons of feed consumption, 68 million tons of deep processing consumption, 12 million tons of edible consumption, and 10 million tons of other consumption.

The trend of diversified supply in the domestic corn market in 2024 will continue. Domestic corn, imported grains, and domestic alternative grains will jointly meet market demand. The inventory of breeding sows will recover and increase, feed consumption expectations will improve, industrial consumption development will be limited, exports will be restricted, industrial consumption growth rate may slow down, and supply increase and consumption weakness may overlap again, limiting the upward space for domestic corn prices in 2024. It is worth noting that the import volume of corn and barley will increase rapidly and continuously in the fourth quarter of 2023, and the interest and usage of barley by feed breeding enterprises will also increase significantly. Therefore, the pressure of corn substitution is also increasing significantly. Overall, there will be enormous pressure on corn supply in 2024, and there will be little significant improvement in annual prices.

Industry

Industry