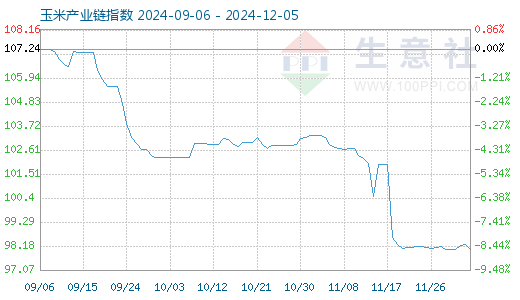

December 6th Corn Industry Chain Intelligence

1. On December 6th, the corn industry chain index was 95.71

On December 6th, the corn industry chain index was 95.71, a decrease of 1.68 points from yesterday, a decrease of 29.34% from the highest point of 135.46 points during the cycle (May 22, 2022), and an increase of 30.45% from the lowest point of 73.37 points on October 11, 2016. (Note: Cycle refers to the present)

The Industry Chain Index is a fixed index created by Business Society based on the commodity industry chain and its various node commodity indices to reflect the overall prosperity of the industry chain.

2. Business Society: On December 6th, the urea market in Hubei Province fell. On December 6th, the latest factory price of urea in Hubei Province was around 1800 yuan/ton, and the price was lowered. Actual transaction negotiations are underway. (Urea details)

3. Business Society: On December 6th, some domestic ethanol manufacturers' quotations remained stable. On December 3rd, Shandong Chengguang Industry and Trade Co., Ltd.'s 50000 tons/year ethanol plant was operating normally. The external quotation for 95% ethanol was reduced by 50 yuan/ton to 5450 yuan/ton, and the external quotation for anhydrous ethanol was 6300 yuan/ton. (Ethanol details)

4. Business Society: On December 6th, the ethanol market in Henan and Hebei regions remained stable. Currently, the premium price reference is 5380 yuan/ton, and the anhydrous price reference is 6200 yuan/ton. (Ethanol details)

5. Business Society: On December 6th, the ethanol market in Southwest China was steadily adjusted. The reference price for cassava ethanol in Yunnan is 6000-6100 yuan/ton, and the reference price for sugar syrup ethanol is 6350-6400 yuan/ton. (Ethanol details)

6. Business Society: The ethanol market has fallen again. According to the Business Society's commodity market analysis system, from December 2nd to 6th, the domestic ethanol price fell from 5437 yuan/ton to 5375 yuan/ton, a decrease of 1.15% during the cycle and a year-on-year decrease of 20.96%. The domestic ethanol market is weak and declining, with some areas affected by previous snowfall, logistics disruptions, and shipment pressure. In addition, there is abundant spot supply, and there is obvious pressure for enterprises to reduce inventory. At the same time, the demand side support is poor, with rigid demand procurement being the main factor, resulting in a decline in ethanol prices. (Ethanol details)

Industry

Industry