After the low opening of CFT's new grain market, there is a new round of chaos in terms of storage or opening

1、 Spot Review

A large amount of new season corn is about to be launched in China, while there is still inventory supply of old season corn. Traders and grain consuming enterprises have adopted low inventory strategies, resulting in a significant decrease in demand for stored grain, spreading market panic, and a sudden increase in supply pressure, leading to an accelerated decline in corn prices. The new and aged corn in Northeast China is difficult to be digested by deep processing and feed enterprises. The morning freight volume of northern ports has rapidly increased, and the enthusiasm of traders to purchase is weak. Prices have slightly weakened, with Jinzhou Port dropping by 110 yuan/ton compared to the previous week; The typhoon in the early stage of the southern port affected the arrival of ships and reduced inventory. However, due to the sharp decline in futures and the successive listing of new grain, the overall demand was limited, and the quoting mentality of port traders weakened. Among them, Shekou Port remained flat on a weekly basis. The domestic spot price of corn is basically stable, with significant drops in local prices. New grain from the Northeast production area has been harvested and listed one after another. Processing enterprises have started to harvest trendy grain, but the prices are low, leading to strong market pessimism. The inventory of aged grain is relatively high compared to the same period last year, and some third-party funds still have repayment pressure at the end of the month. Grain holding entities have a high willingness to ship and continue to sell at a loss. Feed companies are cautious about purchasing new corn, and they purchase it based on sales. Deep processing enterprises have contract grain supplements, and most companies continue to purchase at a lower price. Among them, Changchun's weekly decline is 10 yuan/ton; Spring corn and new season corn in the Huang Huai region of North China have been harvested and put on the market one after another. Traders have unsold old grain, and the overall enthusiasm for selling grain is high. The market supply is relatively sufficient, and the arrival volume of deep processing enterprises has reached a high level. Most of the goods received by processing enterprises are wet grain, which is not conducive to preservation. Deep processing enterprises control the purchase volume and continue to lower the purchase price, with Zhengzhou experiencing a weekly decrease of 210 yuan/ton.

2、 Futures Review

US corn: CBOT December corn contract closed down 4 cents on September 20, 2024, at 401.75 cents per bushel. Due to heavy seasonal harvest pressure, there is active technical selling. On September 23, 2024, the CBOT December corn contract closed up 11.75 cents at 413.50 cents per bushel. Harvesting slowed down due to rainfall. On September 24, 2024, the CBOT December corn contract closed 1.75 cents lower at 411.75 cents per bushel. Due to heavy harvest pressure. On September 25, 2024, the CBOT December corn contract closed 1.75 cents lower at 411.75 cents per bushel. Due to heavy harvest pressure. On September 26, 2024, the CBOT December corn contract closed 2 cents lower at 413.25 cents per bushel. Due to weak export data.

Dalian corn: Dalian Commodity Exchange (DCE) corn main contract 2411, opened at 2158 yuan on September 23, closed at 2138 yuan, down 26 yuan, highest price 2158 yuan, lowest price 2105 yuan, settlement price 2134 yuan; On September 24th, the opening price was 2136 yuan, the closing price was 2150 yuan, an increase of 16 yuan, the highest price was 2152 yuan, the lowest price was 2121 yuan, and the settlement price was 2136 yuan; On September 25th, the opening price was 2157 yuan, the closing price was 2137 yuan, an increase of 1 yuan, the highest price was 2162 yuan, the lowest price was 2135 yuan, and the settlement price was 2148 yuan; On September 26th, the opening price was 2131 yuan, the closing price was 2150 yuan, an increase of 2 yuan, the highest price was 2153 yuan, the lowest price was 2119 yuan, and the settlement price was 2135 yuan; On September 27th, the opening price was 2152 yuan, the closing price was 2179 yuan, an increase of 44 yuan, the highest price was 2186 yuan, the lowest price was 2149 yuan, and the settlement price was 2171 yuan.

1. The EU Grains Chamber of Commerce (Coceral) released its quarterly report on Friday, lowering its forecast for grain production in the EU and UK for 2024/25 by 15.7 million tons, from the June forecast of 296 million tons to 280.3 million tons. The lowered production is nearly 5% lower than 2023 due to adverse weather conditions.

2. According to data released by the Ukrainian Ministry of Agriculture, as of September 20th, Ukraine's grain exports for 2024/25 reached 9.3 million tons, an increase of 57.6% compared to the same period last year's 5.9 million tons.

3. The US government meteorological report shows that as of the week of September 14th, widespread heavy rainfall in eastern Europe has caused floods, while the weather in Ukraine and Russia in Europe remains hot and dry.

4. The Buenos Aires Grain Exchange (BAGE) reported that the corn planting progress for 2024/25 reached 7.1%, an increase of 2.2% compared to the same period last year.

5. The Ukrainian Ministry of Agriculture stated that as of September 19th, Ukraine has harvested approximately 31.875 million tons of grain, covering an area of 7.511 million hectares (equivalent to 68% of the planned harvest area of 11.116 million hectares), with an average yield of 4.24 tons per hectare.

6. As of September 15th, the grain export volume of the 27 EU countries for the fiscal year 2024/25 (starting from July 1st) was 7766957 tons, a decrease of 24% compared to the same period last year and a decrease of 24% compared to the same period last week.

7. As of September 15th, the grain imports of the 27 EU countries in 2024/25 (starting from July 1st) were 6578583 tons, a decrease of 2% compared to the same period last year and a decrease of 1% year-on-year last week.

8. On September 23, China Grain Reserves Corporation Henan Branch's corn bidding procurement results showed that they planned to purchase 6115 tons of corn, with a transaction quantity of 6115 tons and a transaction rate of 100%.

9. On September 23, China Grain Reserves Corporation Shandong Branch's corn bidding sales results showed that 4256 tons of corn were planned to be sold, with a transaction quantity of 1831 tons and a transaction rate of 43%.

10. China Grain Reserves Corporation Guangdong Branch Corn Bidding Sales Results on September 23: Planned to sell 4588 tons of corn, with a transaction quantity of 2019 tons and a transaction rate of 44%

11. On September 23, China Grain Reserves Corporation Inner Mongolia Branch conducted a two-way corn purchase and sale transaction, with a planned trading volume of 29262 tons and a trading volume of 13100 tons, resulting in a trading rate of 45%.

12. On September 23, China Grain Reserves Corporation Xi'an Branch conducted a two-way corn purchase and sale transaction, with a planned trading volume of 23334 tons and a transaction rate of 100%.

13. Traders reported that the Algerian National Grain Agency (ONAB) purchased an unknown quantity of feed corn through an international tender that ended last Wednesday.

14. As of the week ending September 19, 2024, the inspection volume of US corn exports was 1102826 tons, compared to 568915 tons last week and 710605 tons in the same period last year.

15. As of last Thursday (September 19th), the average price of corn wine residue (DDGS) in 34 regions of the United States was $143 per ton, an increase of $2 from a week ago.

16. As of September 16th, the excellent corn yield in France is 80%, higher than 79% a week ago, but still lower than 81% in the same period last year.

17. The Russian Ministry of Agriculture has issued a notice stating that from September 25th to October 1st, 2024, the benchmark price for corn will be 189.5 US dollars per ton, and the export tariff will be 292.7 rupees per ton; The benchmark price for the previous week was 193.6 US dollars, with an export tariff of 446.3 rupees per ton.

18. The Ukrainian Ministry of Agriculture stated that as of September 23, the grain export volume of Ukraine for the 2024/25 fiscal year (starting from July) was 9.437 million tons, higher than 8.676 million tons a week ago, an increase of 53.4% from 6.152 million tons in the same period last year, and a year-on-year increase of 47.0% a week ago.

19. According to consulting firm AgRural, as of September 19th, the first quarter corn planting area in central and southern Brazil for 2024/25 has reached 26% of the expected area, up from 19% a week ago, but still lower than the 25% in the same period last year.

20. On September 24th, China Grain Reserves Corporation Beijing Branch's corn bidding procurement results showed that they planned to purchase 3095 tons of corn, with a transaction quantity of 3095 tons and a transaction rate of 100%.

On September 24th, China Grain Reserves Corporation Zhejiang Branch's corn bidding procurement results showed that they planned to purchase 1000 tons of corn, with a transaction quantity of 1000 tons and a transaction rate of 100%.

22. On September 24th, China Grain Reserves Corporation Shanxi Branch's corn bidding sales results showed that they planned to purchase 6863 tons of corn, with a transaction quantity of 1990 tons and a transaction rate of 29%.

23.On September 24th, China Grain Reserves Corporation Chengdu Branch's corn bidding sales results showed that the planned sales volume was 7147 tons of corn, with a transaction quantity of 1501 tons and a transaction rate of 21%.

24.On September 24th, China Grain Reserves Corporation Jiangxi Branch conducted a two-way corn purchase and sale transaction, with a planned trading volume of 9588 tons and a transaction rate of 100%.

25.On September 24th, the bidding sales results of imported corn (genetically modified) on China Grain Reserves Network showed that the planned sales quantity was 353244 tons, but the actual transaction was 116571 tons, with a transaction rate of 33%.

26.Government and industry officials have stated that workers at six major grain terminals located in the Port of Vancouver, Canada, went on strike on Tuesday, which could disrupt exports of rapeseed and other crops.

27. In 18 states that account for 92% of the country's corn planting area, as of Sunday, September 22, the proportion of corn entering the pit stage in the United States was 92%, with a five-year average of 91%. The maturity rate of corn is 61%, with a five-year average of 55%.

28. The Brazilian National Commodity Supply Company (CONAB) stated that as of September 22, the progress of corn planting in the first quarter of 2024/25 was 16.2%, higher than 12% a week ago and 18.3% in the same period last year.

29. The Ukrainian National Meteorological Agency stated that as of September 20th, the sowing conditions for winter crops in most parts of Ukraine are still unsatisfactory.

30. A report released by the Ukrainian Agricultural Enterprise Club (UCAB) states that the Ukrainian national railway company Ukrzaliznytsia plans to increase railway freight taxes, which will hit farmers who are already struggling due to the international food downturn and may lead to a decrease in Ukraine's grain production and exports.

31. American farmers participating in the annual crop observation project reported that their corn and soybean yield ratings were downgraded last week. Although they are expected to be slightly higher than the historical average, the early harvest results have already shown the adverse effects of dry weather in the late growing season.

32.On September 25th, China Grain Reserves Corporation Jilin Branch's corn bidding procurement results showed that they planned to purchase 28556 tons of corn, with a transaction quantity of 18562 tons and a transaction rate of 65%.

33. China Grain Reserves Corporation Inner Mongolia Branch's corn bidding procurement results on September 25th: The planned purchase of 35500 tons of corn was 35500 tons, with a transaction quantity of 35500 tons and a transaction rate of 100%.

34.On September 25th, the Xi'an branch of China Grain Reserves Corporation announced the bidding results for corn procurement: a planned purchase of 7543 tons of corn was made, with a transaction quantity of 7543 tons and a transaction rate of 100%.

35.On September 25th, China Grain Reserves Corporation Shandong Branch's corn bidding procurement results showed that they planned to purchase 20451 tons of corn, with a transaction quantity of 20451 tons and a transaction rate of 100%.

36.Analysts expect this report to show that the net sales volume of US corn exports for the week ending September 19, 2024 may range from 600000 to 1.3 million tons.

37. Traders stated that the Algerian National Grain Agency (ONAB) held an international tender to purchase 240000 tons of feed corn, sourced only from Argentina or Brazil.

38. The US Department of Agriculture stated that private exporters reported selling 180000 tons of US corn to unknown destinations for delivery in 2024/25.

39. North American supply chain issues continue to be closely monitored by the market, and there may be strikes at ports along the East Coast and Gulf of Mexico, which could cause logistics disruptions in the coming weeks and months.

40. The Ukrainian Ministry of Agriculture stated that as of September 25th, Ukraine's grain exports for the 2024/25 fiscal year (starting in July) were approximately 9.8 million tons, up from 8.9 million tons a week ago and an increase of 58.7% from 6.15 million tons in the same period last year.

According to statistics from the Brazilian Foreign Trade Secretariat (Secex), Brazil's corn exports were 4.7 million tons from September 1 to 20, 2024, up from 3.08 million tons a week ago and 8.75 million tons for the entire month of September last year.

42. The Brazilian Association of Grain Exporters (ANEC) stated that ANEC estimates Brazil's corn exports for September to be 668.6 tons, higher than the estimated 6.634 million tons a week ago.

43. Crop seed giant Corteva stated that crop issues in some parts of South America mean the company may not be able to meet its earlier 2024 profit forecast.

44.According to a report released by the Rosario Grain Exchange, under normal weather conditions, Argentina's grain and oilseed production in 2024/25 may reach 143.2 million tons, an increase of 9.3% from the previous year's 131 million tons, which could push export volumes to the highest level in four years.

45.According to the Southern Hemisphere Spring Forecast released by RuralClima, the expectation of normal rainfall in Brazil after mid October remains unchanged, although this does not mean that there was no rainfall before.

46. On September 26th, China Grain Reserves Corporation Lanzhou Branch's corn bidding sales results showed that they planned to purchase 6259 tons of corn, with a transaction quantity of 2003 tons and a transaction rate of 32%.

47. On September 26th, China Grain Reserves Corporation Guangdong Branch's corn bidding procurement results showed that they planned to purchase 2588 tons of corn, with a transaction quantity of 2588 tons and a transaction rate of 100%.

48. China Grain Reserves Corporation Guangxi Branch's corn bidding procurement results on September 26th: The planned purchase of corn is 28023 tons, with a transaction quantity of 28023 tons and a transaction rate of 100%.

49.On September 26th, China Grain Reserves Corporation Chengdu Branch's corn bidding procurement results showed that they planned to purchase 5400 tons of corn, with a transaction quantity of 5400 tons and a transaction rate of 100%.

50.On September 26th, China Grain Reserves Corporation Hunan Branch's corn bidding procurement results showed that they planned to purchase 16500 tons of corn, with a transaction quantity of 16500 tons and a transaction rate of 100%.

51. The US Department of Agriculture stated that private exporters reported selling 115000 tons of US corn to Mexico for delivery in 2024/25.

52. The weekly export sales report of the US Department of Agriculture shows that in the third week of 2024/25, the US corn export to China (mainland) (excluding the sales volume not shipped) decreased by 99.0% year on year.

53.As of September 18th, Argentine farmers have sold 32.69 million tons of 2023/24 corn, which is 1.12 million tons higher than a week ago. Last year's sales for the same period were 24.13 million tons. The sales volume in the previous week was about 1.19 million tons.

54.According to data from the Russian Ministry of Agriculture, as of September 23, Russian farmers have harvested 78% of the grain planting area, with 105.9 million tons of grain harvested, including 77.7 million tons of wheat.

55.According to consulting firm SovEcon, as of September 20th, the winter grain planting area in Russia was 8.3 million hectares, lower than the same period last year and the five-year average (both 9.3 million hectares), and also the lowest level since 2013, due to unfavorable weather conditions in the main production areas.

56.According to the analysis center of Rusagrotrans, Russia's grain production for 2024/25 is expected to be 124.2 million tons, including 82 million tons of wheat.

57.According to the consulting firm IKAR in Moscow, Russia's grain production for 2024/25 has been reduced by 500000 tons, from the previously expected 125 million tons to 124.5 million tons.

58.Elena Churina, Director of RGU Analysis Department, stated that from September 1st to 20th, Russia exported 4.09 million tons of grains, a year-on-year decrease of 18.7%. Among them, the export of wheat was 3.753 million tons, a year-on-year decrease of 10.8%; The export volume of barley was 257000 tons, a year-on-year decrease of 60.9%; The export of corn was 82000 tons, a year-on-year decrease of 50.6%.

59. Russia is expanding its Baltic ports with the goal of increasing agricultural exports by 50% by 2030 while reducing reliance on traditional Black Sea routes.

60.According to data from the European Union Statistics Office, the EU imported only 9835 tons of biodiesel from China in July, a decrease of 91% compared to the previous month and the lowest point since April 2021.

61. According to the industry publication Oil World in Hamburg, Germany, the production of biodiesel and hydrogenated vegetable oil (HVO) in the United States in August 2024 was 1.16 million tons, a new low in nine months.

62.The Crop Forecasting Council of South Africa (CEC) stated that the corn production in South Africa in 2024 will be 12.8 million tons, lower than the forecast of 13.06 million tons in August and also lower than the previous year's 16.43 million tons.

63. The Brazilian Amazon Basin Ports and Cargo Association (Amport) stated that the widespread drought in Brazil has caused disruptions in grain transportation along the Madeira River.

64.The latest data released by Eurostat shows that the average price of agricultural output in the second quarter of 2024 decreased by 3% compared to the same period in 2023.

65. China Grain Reserves Corporation Lanzhou Branch's corn bidding sales results on September 27th: The planned purchase of corn is 5709 tons, with a transaction quantity of 3083 tons and a transaction rate of 54%.

66. On September 27th, China Grain Reserves Corporation Inner Mongolia Branch conducted a two-way corn purchase and sale transaction. The planned transaction volume was 7562 tons of corn, with a transaction quantity of 4450 tons and a transaction rate of 59%.

4、 Pig market

Pig prices have continued to decline month on month this week. The sentiment of pessimistic outlook on the future trend of pig prices in the breeding industry is on the rise, and the selling sentiment is increasing, resulting in a continued increase in safe operation; On the consumer side, although the summer heat wave is gradually coming to an end and the weather is getting cooler with the upcoming National Day holiday, the demand for pork consumption by residents will gradually enter the autumn and winter peak season, which will gradually enhance the boosting effect on pork prices and pork prices. However, due to the impact of the economic environment, the current consumption performance is still weak, and the market continues to show a state of oversupply, with pig prices continuing to decline during the week. However, with continuous price reductions and the approaching National Day holiday, there has been a resurgence of reluctance in the breeding industry to sell pigs. In some areas, the popularity of secondary fattening has once again increased, and the decline in pig prices has significantly slowed down in the second half of the week. It is predicted that the probability of a weak price correction will be higher during the late September and early October period after the holiday due to the pressure of increased concentration of slaughter. The continued upward momentum of pig prices will not be reflected, which is the result of the continued rise in pig prices in previous months overdrawn the later market dividends, and is also the result of the rational adjustment of the market based on the fundamental principle of "no shortage of pigs, no shortage of meat". We still believe that the overall price of slaughtered pigs from October to December will continue to be high. Although the price of slaughtered pigs from October to January will still be above the profit and loss line, the overall trend of prices is more likely to show a weak correction and consolidation compared to the first half of August. Overall, the probability of pig prices falling in the fourth quarter compared to the third quarter is further increasing.

5、 Corn inventory

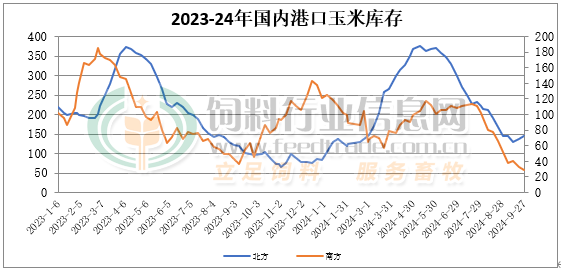

As of September 27th, the total corn inventory in the four northern ports was about 1.45 million tons. Traders from Northeast China continue to ship goods, and the new season of corn has also begun to be harvested and put on the market. The port volume in northern China has increased. As of Friday, the corn inventory at Guangdong ports was 293000 tons. Most enterprises have already entered the stage of stocking up for National Day, with a slightly faster delivery speed. The daily average shipment of domestic corn is 15000 tons.

6、 Market analysis in the future

In September, the inventory of aged corn in China will continue to decline, and the total consumption of corn on the demand side of breeding and feed production will continue to increase month on month. The consumption of deep processing sector will gradually increase as the operating rate will gradually increase, and the total consumption will continue to grow. Overall, during the September period, the domestic supply of aged corn will continue to be in a stagnant stage, and the overall trend of further tightening supply remains unchanged. Theoretically, both the supply and demand sides will continue to have positive support for prices. On the other hand, the sales of spring corn in the southern and central regions will continue to increase, and the tight supply of aged corn is expected to ease moderately. The combination of overdue reserves of alternative raw materials such as corn, wheat, and rice will continue to be auctioned and listed, and the supply of imported corn substitutes is generally sufficient. Therefore, the overall situation of sufficient corn supply remains unchanged. It is predicted that during the period of September to October, corn prices are more likely to remain stable with a slightly weak trend, except for temporary short-term rebound opportunities. Pay close attention to the impact of later weather conditions on the growth and harvesting of corn in the production area.

Industry

Industry